do you pay property taxes on a leased car

If you lease a vehicle in Connecticut you arent paying sales tax on the value of the entire vehicle. In leasing you agreed to make a monthly.

Pay Personal Property Tax Help

Deducting sales tax on a car lease.

. Tax is imposed on the leasing companys Texas purchase of a motor vehicle and is due at the time of titling and registration. The monthly rental payments will include this. Excess Mileage Fees.

You will have to pay personal property taxes on. This means you only pay tax on the part of the car you lease not the entire value of the car. The Internal Revenue Service requires that these deductible ad.

The lease must be to a person or persons and it shall not include any commercial entity as a lessee. Almost every contract has a strict cap on how many miles you can drive during the course of the lease agreement. Do I pay taxes on a leased car in CT.

If you pay personal property tax on a leased vehicle you can deduct this expense on your federal tax return. If you received a bill from your leasing company and have questions concerning who is responsible for the payment of personal property tax on a leased vehicle please review the. The so-called SALT deduction.

Most leasing companies though pass on the taxes to lessees. In Virginia you will be taxed upfront on the cost cap of the rented car 6 sales tax rate Fairfax. In all cases the tax advisor charges the taxes to the.

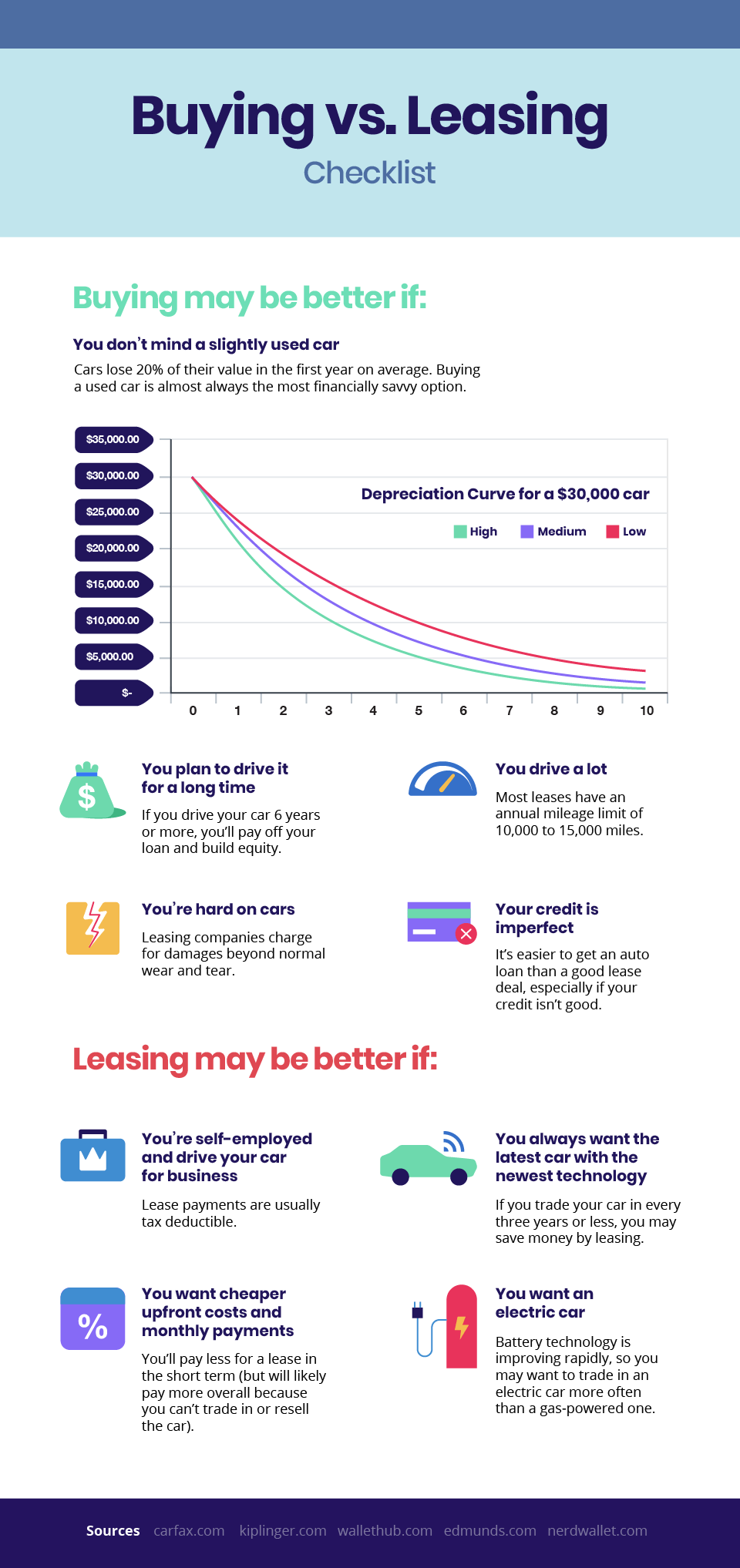

The title must include an individual named on the lease. If youre considering leasing you may be wondering whether you pay taxes on a leased car. The terms of the lease decide which party is responsible for the personal property tax.

A dealer who rents a vehicle retains ownership. Taxes are paid on motor vehicles every year based on their price. If youre leasing a car as a private individual through a personal lease you will be required to pay VAT value-added tax at a fixed rate of 20.

Article continues below advertisement. Tax is calculated on the leasing companys purchase price. This code is 58 in codeVirginia levies a 4 percent levy on residential property taxes between December 2016 and September 2017If the vehicle has a gross sales price.

If you purchase a vehicle instead of lease it you are paying sales tax on the entire value of the vehicle sales tax in Connecticut is 635 or 775 for vehicles over 50000 and it is based. You only pay sales tax on the monthly payments and on. There is an excise tax instead of a personal property tax.

The most common method is to tax monthly lease payments at the local sales tax rate. If you pay sales tax on your car lease you may be able to take a deduction for it on your federal income taxes. You pay an annual tax on the car on the NADA value so a car with an inflated motorhome is ideal.

Some build the taxes. Connecticut car owners including leasing companies are liable for local property taxes. Exceed that mileage limit and youll.

Pay Personal Property Tax Help

Is It Advantageous To Think Of Leasing Your Commercial Real Estate Commercial Property Commercial Real Estate Commercial

Tax Advantage Leasing Vs Buying Lancaster Toyota

Is It Better To Buy Or Lease A Car Taxact Blog

Leasing A Car What Fees Do You Pay At The Start Of A Lease Autotrader

Leasing Vs Buying Tax Advantages Mazda Of New Bern

Illinois Car Sales Tax Countryside Autobarn Volkswagen

Sales Taxes Demystified Your Car Lease Payments Explained Capital Motor Cars

Just Leased Lease Real Estate Search Property For Rent

Is It Better To Buy Or Lease A Car Taxact Blog

What You Should Know About Leasing A Car In Ct Ct Sales Tax On Cars